-

Who We Are

Who We Are

For the last century, we’ve dedicated ourselves to empowering families like yours to prosper and endure. Like many of the leading families we serve, we have been through our own wealth journey.

Discover Pitcairn -

What We Do

Wealth Momentum®

The families we serve and the relationships we have with them are at the center of everything we do. Our proprietary Wealth Momentum® model harnesses powerful drivers of financial and family dynamics, maximizing the impact that sustains and grows wealth for generations to come.

Explore - Insights & News

Just as taxes are certain, changes to tax laws are inevitable. The most notable recent revision to the US tax code was the Tax Cuts and Jobs Act of 2017 (TCJA). The TCJA made sweeping changes to corporate tax rates, individual marginal tax rates, deductions, and exemptions. However, certain provisions of this law were temporary, and if Congress doesn’t act, these provisions will no longer be in effect for tax years beginning after December 31, 2025.

Setting expiration dates on tax code provisions is commonly known as “sunsetting.” Throughout this year and next, you will likely see media reports about this sunsetting and interpretations and advice from many financial service providers. The expiration of TCJA provisions is an issue that requires attention from taxpayers and lawmakers alike.

In this article, we help you filter out the noise surrounding the TCJA sunsetting and focus on the aspects that matter most to wealthy families. We also share how we can work together to ensure that your tax plan is best prepared for whatever happens between now and 2026 and beyond.

Before we delve into specific considerations, there are two important caveats:

- No one knows yet what tax legislation will be passed over the next two years and beyond. Congress may extend some or all provisions or allow them to expire. Congress may also pass other tax code changes unrelated to the TCJA. There’s just no way to predict what legislation may pass.

- Some of the hype means nothing for families of wealth. Not all issues highlighted in the media or by other financial professionals are of equal importance. Some provisions will have little or no effect on your long-term wealth and tax planning, while others may have a critical impact. It’s important to understand that your individual circumstances play a significant role in determining the impact of these provisions on your wealth and tax planning.

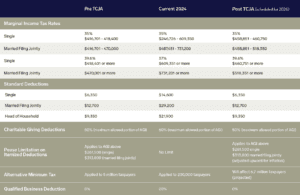

Table 1: Summary of Select TCJA Provisions Scheduled to Sunset in 2026

Tax Liability

Tax Rates and Deductions

Among other provisions, the TCJA lowered marginal tax rates for individuals, nearly doubled the standard deduction, and changed the limit on contributions to charitable organizations: contributions, which had increased to 60% (100% during COVID), will revert to 50%. After 2025, marginal tax rates are scheduled to return to higher levels, standard deductions will be lowered to previous levels, and the limit on charitable contributions will be increased. The Pease limitation, which capped itemized deductions for high-income taxpayers, will also be reinstated. All of these would likely increase annual tax liability.

However, sunsetting will also return certain itemized deductions to pre-2017 status, including state and local tax (SALT) deductions, the higher limit for mortgage interest deductions (from $750,000 to $1,000,000), return of the deduction for home equity loans up to $100,000), and miscellaneous itemized deductions. The deductions attributable to investment income would further reduce the amount of net investment income subject to higher marginal tax rates. These provisions may counterbalance the effects of higher marginal rates and other negative impacts.

At the most basic level, advice on planning for TCJA expirations seems to center on accelerating income into 2025 and deferring deductible expenses until 2026. Generally, that seems prudent for taxpayers who can shift their income and expenses effectively during those two years, but it’s not necessarily a one-size-fits-all solution. A particular benefit would be to generate 2025 income, for which state taxes would not have to be paid until 2026. Revival of the Pease limitation and resulting caps on itemized deductions will complicate decisions about the timing of deductions, as will the alternative minimum tax, which we cover in more depth below

Beware of General Tax Advice

Amid widespread hype about the TCJA sunsetting, we want to caution our families that some guidance for the general public could actually be ill-advised for families with substantial wealth. For example, we continually see recommendations to convert traditional IRAs to Roth IRAs before 2026, while marginal tax rates are lower. However, that advice disregards financial and estate plans in which IRAs are often designated as “excess assets” allocated for charitable donations. Converting to a Roth IRA may mean paying a lower tax today, but isn’t it better to avoid that tax entirely? We can accomplish this outcome through comprehensive planning.

A Roth IRA conversion is just one example of popular guidance that could backfire for families of wealth. The complexity of addressing tax code changes requires meticulous and holistic analysis, early planning, and properly timed implementation.

For Better or Worse, the AMT Comes Back

The Tax Policy Center projected that the number of taxpayers subject to the alternative minimum tax (AMT) would fall from 5 million taxpayers in 2017 to just 200,000 taxpayers in 2018, a number expected to remain roughly constant through 2025. Assuming no change to the expiration of AMT provisions, that number jumps sharply in 2026 when the Center expects the AMT to affect 6.7 million taxpayers.

Pitcairn clients are very likely to be among those once again facing the AMT. This is not necessarily bleak news. Despite its negative connotations, we have found that the AMT can create advantageous planning opportunities. Typically, wealthy taxpayers are subject to the AMT because they pay high state and local taxes and have substantial miscellaneous itemized deductions. This means they have maximized their allowable deductions to effectively offset the highest marginal tax rates and be subject to a marginal rate of 28%.

In the past, we have done some very effective planning around the AMT. By judiciously timing when income is received and deductions are accrued, we have actually helped clients benefit from the AMT.

Loss of Qualified Business Income Deduction Raises Questions for Business Owners

The TCJA allowed owners of passthrough businesses and sole proprietors to deduct up to 20% of qualified business income. This provision was inserted to bring the after-tax return on flow-through income in line with double-taxed dividends. That deduction expires for Tax Year 2026 unless Congress intervenes. Given that the TCJA tax cuts for corporations (flat 21% tax rate) do not expire, the loss of the QBI deduction may affect business formation strategies and tax elections, considerations that would be part of comprehensive tax planning for Pitcairn clients.

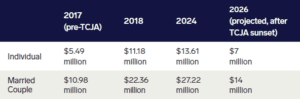

The Clock is Ticking for Estate Planning and Gifting Strategies

The TCJA roughly doubled the lifetime estate and gift tax exemption. If this provision sunsets in 2025, the 2026 exemption will return to 2017 levels, adjusted for inflation. This would significantly reduce the amount taxpayers can utilize for their wealth transfer planning.

There are three important reasons to start planning now. First, gifting and trusts should be part of a well-thought-out plan that supports your overall estate objectives and considers what assets you will and won’t need to support your lifestyle expense.. Give yourself time to reflect on your intentions. Second, the looming expiration date could put a strain on estate planning resources. Under a similar deadline in 2012, it was challenging to find lawyers and other specialists with the right expertise and available bandwidth to draft complex estate and trust documents. Third, depending on the trust and the assets utilized for funding the trust, clients should expect that the process requires time to execute the plan.

We encourage early action to avoid last-minute scrambles that could compromise quality and lead to buyer’s remorse if rushed planning doesn’t produce the desired results. Furthermore, there really is no reason to delay. If you intend to gift certain assets, there’s no benefit to waiting.

With the possibility of significantly lower exemption limits in 2026, families should discuss their options with their wealth advisor. Having a conversation may lead families to conclude they are satisfied with the planning they have done and feel no pressure to use up any remaining exemption at this time.

However, families who decide that further action is needed will want to have plenty of runway to implement their plans well before the logjam that might occur later in 2024 through 2025. The most important thing is that decisions and strategies be purposeful, not rushed by lack of time or resources.

Estate & Gift Tax Exemptions

Using Your Expanded Exemption

Some strategies to use the expanded exemption while it is available include gifting to family members, including a spouse, trusts, charitable donations, and business succession planning.

Giving to a spouse and/or family members can be done via a spousal lifetime access trust (SLAT). One spouse establishes an irrevocable trust for the benefit of their spouse and other beneficiaries (likely children and grandchildren) and funds the trust up to the lifetime estate and gift tax exclusion (also referred to as an exemption/$13.61 million in 2024). While both spouses are alive and married, the grantor spouse retains indirect access to the trust’s income and assets, which alleviates concerns about relinquishing control and not having access to assets that might be needed for their lifestyle

Gifting can also be accomplished through intrafamily loans and the forgiveness of loans. Using loans can be tricky as certain conditions must be met, such as charging a market interest rate. Also, loans that are not repaid are considered gifts and subject to gifting regulations.

Gifting now can avoid certain state transfer taxes (i.e. PA Inheritance Tax) if done during lifetime rather than upon death.

Assets may also be gifted by allocating the generation-skipping trust exemption to existing family trusts that are not fully exempt from the tax on generation-skipping trusts.

Conclusion

These days many professionals in the financial industry are putting forth their recommendations for addressing the sunsetting of TCJA provisions. We know what will happen if Congress takes no action, but beyond that, everything is speculation at this point. There’s a wide range of possibilities between Congress doing nothing and Congress extending all provisions. For now, it’s prudent to avoid actions predicated on supposition.

Amid such legislative uncertainty, we help our clients implement sound tax strategies reflecting current law. We also closely monitor Congress to anticipate future code changes and prepare to take action when appropriate.

We urge clients to proceed with caution and talk to us. When evaluating your tax situation, we consider all such nuances and take into account your family’s unique circumstances before implementing any tax strategy.

If you have questions or concerns about your tax situation, please reach out to your Pitcairn Relationship Manager. At Pitcairn, our focus on issues particularly relevant to families with multi-generational wealth ensures that tax planning is an integrated component of comprehensive wealth planning.

Disclaimer: Pitcairn Wealth Advisors LLC (“PWA”) is a registered investment adviser with its principal place of business in the Commonwealth of Pennsylvania. Registration does not imply a certain level of skill or training. Additional information about PWA, including our registration status, fees, and services is available on the SEC’s website at www.adviserinfo.sec.gov. This material was prepared solely for informational, illustrative, and convenience purposes only and all users should be guided accordingly. All information, opinions, and estimates contained herein are given as of the date hereof and are subject to change without notice. PWA and its affiliates (jointly referred to as “Pitcairn”) do not make any representations as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether referenced or incorporated herein, and takes no responsibility thereof. As Pitcairn does not provide legal services, all users are advised to seek the advice of independent legal and tax counsel prior to relying upon or acting upon any information contained herein. The performance numbers displayed to the user may have been adversely or favorably impacted by events and economic conditions that will not prevail in the future. Past investment performance is not indicative of future results. The indices discussed are unmanaged and do not incur management fees, transaction costs, or other expenses associated with investable products. It is not possible to invest directly in an index. Projections are based on models that assume normally distributed outcomes which may not reflect actual experience. Consistent with its obligation to obtain “best execution,” Pitcairn, in exercising its investment discretion over advisory or fiduciary assets in client accounts, may allocate orders for the purchase, sale, or exchange of securities for the account to such brokers and dealers for execution on such markets, at such prices, and at such commission rates as, in the good faith judgment of Pitcairn, will be in the best interest of the account, taking into consideration in the selection of such broker and dealer, not only the available prices and rates of brokerage commissions, but also other relevant factors (such as, without limitation, execution capabilities, products, research or services provided by such brokers or dealers which are expected to provide lawful and appropriate assistance to Pitcairn in the performance of its investment decision making responsibilities). This material should not be regarded as a complete analysis of the subjects discussed. This material is provided for information purposes only and is not an offer to sell or the solicitation of an offer to purchase an interest or any other security or financial instrument.