-

Who We Are

Who We Are

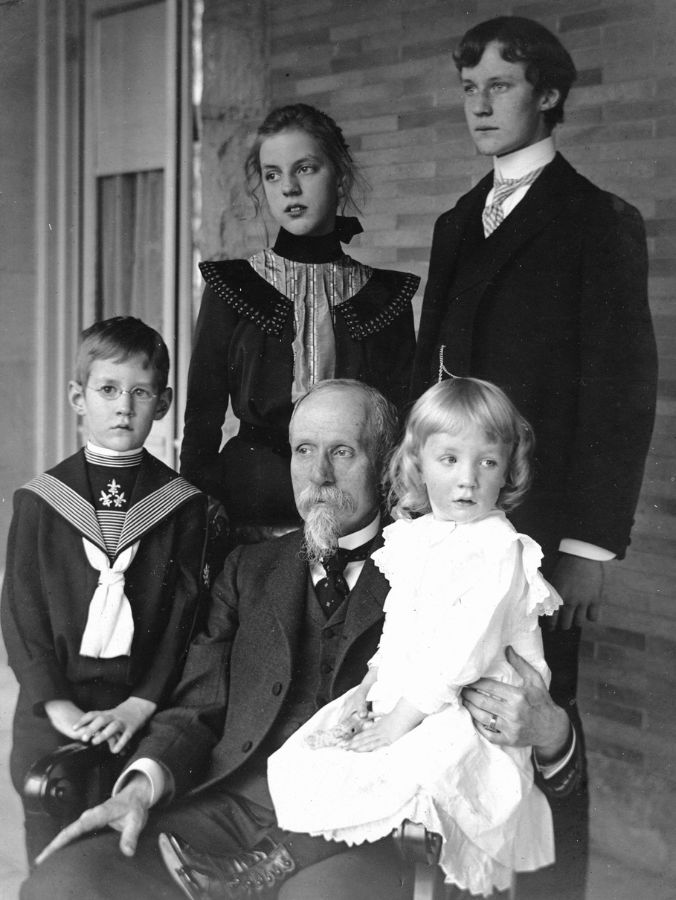

For the last century, we’ve dedicated ourselves to empowering families like yours to prosper and endure. Like many of the leading families we serve, we have been through our own wealth journey.

Discover Pitcairn -

What We Do

Wealth Momentum®

The families we serve and the relationships we have with them are at the center of everything we do. Our proprietary Wealth Momentum® model harnesses powerful drivers of financial and family dynamics, maximizing the impact that sustains and grows wealth for generations to come.

Explore - Insights & News

Custom Investment Solutions Guided by Objective Analysis

We build investment portfolios specific to our clients' unique needs and objectives. Hallmarks of our approach include objectivity, diversification, and a long-term perspective. We do not recommend proprietary financial products nor accept commissions, attempting to align our interests with those of our client families.

Equities Drive Long-Term Success

To harness the wealth accumulation potential of global equities, we remain mindful that valuations matter. We thoughtfully blend active and passive investment strategies.

Diversification is Paramount

Equities may rule over the long term but won't always lead capital markets in the short term. Diversification reduces risk and delivers a smoother path to achieving one's overall goals.

Bespoke Portfolios Achieve Better Results

There is no “one-size-fits-all” investment solution. We closely align our clients' investment strategies with their overall wealth plan, including family goals, liquidity needs, and risk tolerance.

Taxes Matter

Taxes are a persistent drag on returns that compounds over time. Our proprietary tax overlay allows us to manage tax implications on a daily basis. We continually look for tax efficient opportunities across all asset classes and pursue ways to mitigate tax liability.

A Robust Investment Platform that Offers Diversified Solutions

Public & Private Equity for the Long-Term

Our rigorous due diligence, deep connections, and extensive experience in the investment community provide a discerning perspective and privileged access to traditional and alternative equity managers, including leading private equity funds.

Fixed Income & Private Credit for Yield & Stability

Fixed income, both public and private credit, plays an important role in diversified portfolios. We may hold fixed income investments to add stability and improve portfolio diversification or to generate income while seeking to preserve purchasing power. Meanwhile, opportunistic investments in private credit can bolster a portfolio's yield profile.

Alternative Investments for Diversification

Hedge funds can give portfolios access to performance drivers that are different from conventional stock and bond positions. When incorporating alternative investments, we consistently focus on risk and liquidity.

Real Assets for Appreciation & Income

Assets such as real estate, infrastructure, and commodities allow portfolios to further diversify away from traditional equities. These holdings help to hedge against inflation and may enhance yield while generating more consistent returns.

*Please note limitations: Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that the future performance of any specific investment or investment strategy, including the investments and/or investment strategies recommended and/or undertaken by Pitcairn, will be profitable, equal any historical performance level(s), or prove successful.