-

Who We Are

Who We Are

For the last century, we’ve dedicated ourselves to empowering families like yours to prosper and endure. Like many of the leading families we serve, we have been through our own wealth journey.

Discover Pitcairn -

What We Do

Wealth Momentum®

The families we serve and the relationships we have with them are at the center of everything we do. Our proprietary Wealth Momentum® model harnesses powerful drivers of financial and family dynamics, maximizing the impact that sustains and grows wealth for generations to come.

Explore - Insights & News

Key Takeaways

- The US bull market has been analyzed, dissected, celebrated, and even prematurely mourned but has continued to run like the Energizer Bunny.

- Though investors should be prepared for a pullback after such a torrid run, there are still more tailwinds than headwinds in US markets right now.

- Only a major step forward in efficiency in the life-altering development of artificial intelligence (AI) will create a sustainable path for the current deficit picture in the US.

- Strategic investors don’t have to wonder whether today’s market has room to rise or faces a significant step down. The beauty of strategic investing is that diversified portfolios are positioned to move forward under either outcome.

The US bull market rocketed higher in the first quarter, with the S&P 500 Index returning 10.56%. This is a bull market that has been analyzed, dissected, celebrated, and even prematurely mourned. Still, this bull has continued to run like the Energizer Bunny. The S&P 500’s first quarter return was the highest in the past five years and among the top 12 on record. This is an emotion-fueled, momentum-driven market like that of the late 1990s. The question now is, how long will it last?

In just the past 12 months, US equities, as measured by the Russell 3000 Index, have risen 30%. That’s almost triple Ibbotson’s 10.5% average annual stock return and far above the typical 7% to 9% capital market assumption for long-term stock returns. Equities are unlikely to deliver another 30% in the next 12 months. Though investors should be prepared for a pullback after such a torrid run, there are more tailwinds than headwinds in US markets right now.

The Case for US Equities in 2024

The macroeconomic backdrop provides multiple reasons for US stocks to perform well for the rest of this year. US GDP growth remains in the 2-2.5% range, unemployment is low, inflation is falling, corporate earnings are rising, and the Federal Reserve has signaled an end to interest rate hikes with cuts possible.

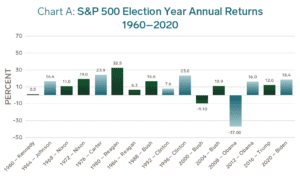

Also in the plus column, this is an election year, and the S&P 500 Index has not fallen in a presidential re-election year since 1944. In re-election years, the administration in power, whether Democrat or Republican, does whatever it can to keep the economy and the stock market rolling along. As you can see in Chart A, they typically succeed.

At the start of 2024, the consensus for S&P 500 earnings was about $242, representing 11% growth. Consensus has risen to about $250 and even that may be low given the possibility of Fed rates cuts and the current administration’s fiscal actions, which goose corporate earnings.

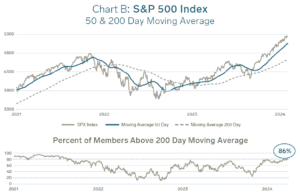

Trends within the US stock market appear healthier as well. Last year, we bemoaned the narrow leadership of the “Magnificent Seven” technology stocks. During the fourth quarter, a broader array of stocks joined in the gains and that trend has solidified. As of quarter end, 86% of S&P 500 stocks were trading above their 200-day moving average, as shown in Chart B. Historically, narrow markets have fallen victim to negative events that take out the few leaders, sparking a downturn. The opposite has happened here, and now leadership has begun to rotate from technology into industrials, financials, and energy. That rotation is a healthy development.

Source: Bloomberg, Data as of 4/1/2024.

It’s a hard call, but I think this market has a bit longer to run. Jason Trennert, CEO of Strategas Research Partners, maintains a list of indicators signaling the top of a bull market. From heavy equity inflows to rising interest rates to investor euphoria, not a single one of those nine variables is currently in play.

Can the Rise of AI Counter Unfettered US Spending?

Two powerful forces will likely shape US equity results in the longer term. On the one hand, higher interest rates, significant US debt, and rising deficits are a likely drag. On the other hand, artificial intelligence (AI) heralds a potentially seminal advance for humanity.

US government spending is currently about 4% of GDP. Spending sprees of this magnitude are more typically seen during recessions when there’s a need to boost the economy. I question whether the US can sustain that level of deficit spending without negatively affecting the US dollar and ultimately capital markets. Furthermore, what happens during a recession – will spending soar to 8% of GDP?

Nevertheless, worry about rising deficits will certainly wane if developments in AI are as life altering as many anticipate. Humanity seems to be on the cusp of a monumental step forward. AI could exponentially boost efficiency and forever alter the way we do things. Improvement in medicine and health care alone may dramatically lengthen life spans and improve quality of life. This impending technological revolution has captivated investors because it will beget corporate earnings events that are ultimately very positive

for capital markets.

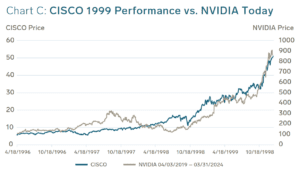

That doesn’t mean we shouldn’t pay attention to US debt or that markets won’t pull back from current levels. US equities are highly valued right now. In 1999, we were told the internet would do amazing things – and it did even more than was promised. However, the S&P 500 and the Nasdaq peaked in 2000. After that bust, the S&P regained its high in 2004; the Nasdaq didn’t reclaim its high until 2016. Certainly, some current AI darlings might be flying too close to the sun. Chart C compares Cisco in 1999 to NVIDIA in 2024. Technology giant Cisco was a market favorite in 1999. Investors were optimistic about potential internet opportunities and Cisco rose 181% that year. In 2024, investors are equally jubilant about potential opportunities related to AI. Current market favorite NVIDIA mirrors Cisco’s upward rise in 1999, having gained over 72% in the first quarter.

Even amid a life-changing technological revolution, there will be downdrafts and excesses to be worked off. I would not bet against NVIDIA In the short term as it has incredible momentum, but it is good to remember Cisco has yet to regain the high shown in the picture above.

US Economy Leads as Other Countries Anticipate Recovery

For the last year or so, the US has been an anomaly among world economies, delivering growth in the 2% range while most countries were in the 0-0.5% range. It’s still early, but there’s some indication the AI revolution will pull the rest of the world up to the US level rather than US growth slowing.

Eight months ago, at least three or four economic indicators pointed to a US recession. Today, it’s only the inverted yield curve. And, as noted earlier, we see US fiscal policy demonstrably supporting economic growth for the rest of 2024 and even working against the Fed’s monetary policy.

Fed Holds Steady With Close Eye on Inflation Data

Expectations for future Fed action changed significantly in the first quarter. At the end of 2023, market expectations got ahead of themselves, anticipating as many as six interest rate cuts in 2024. Instead, inflation has been annoyingly slow to fall and, as a result, the Fed has pushed back the timeframe for cuts. I don’t think the Fed ever intended to cut rates six times in 2024, but its dot plots and conversations revealed a desire to cut and led forecasters to be overly optimistic. The futures market now predicts one or two cuts and not until late summer.

Given the current data, one could wonder why the Fed would cut rates? The Atlanta Fed’s GDPNow forecasts a 2.4% annualized GDP growth rate for the first quarter, the US boasts full employment, and asset values are at record levels. This is not an environment where the Fed needs to step on the economic gas. However, the Fed rationalizes its plan based on “relative restrictiveness.” If inflation falls and the Fed takes no action, that is a de facto tightening of monetary policy. Conversely, a Fed cut in response to falling inflation leaves the level of monetary restrictiveness unchanged.

This year’s election presents another obstacle to rate cuts. The Fed wants to cut rates but hasn’t gotten inflation data that would support it. Meanwhile, Treasury Secretary Janet Yellen is doing what all administrations do to support their party – stoking the economy. That puts the administration and the Fed at cross purposes to some extent.

Unlike futures markets and most investors, I think there is a good chance the Fed will cut rates as early as June. My view is the Fed won’t want to cut between June and November when it might be perceived as affecting the election. However, the Fed might feel that waiting until after the election to cut rates would be too late. A cut in June would boost investor sentiment as recent data call into question even one cut in 2024. Conversely, if the Fed signals it will hold off until the first quarter of 2025, stocks would decline more than they did in mid-April when March inflation numbers came in higher than expected. My thesis requires more benign inflation data between now and June, but I believe this is the path Fed Chairman Jerome Powell prefers.

At the start of the year, markets were pricing in five interest rate cuts and 11% earnings growth. No way could both happen, in our view. Back then, I thought we might get the interest rate cuts and not the earnings growth. Now, I expect the opposite. S&P 500 earnings will probably reach $250 or $255, with the Fed possibly cutting rates just once or twice.

Japan Raises Interest Rates, A Notable Indicator for Global Inflation

During the quarter, the Bank of Japan raised interest rates for the first time in 17 years. That is momentous and, I believe, a harbinger of higher global interest rates. When I visited Japan with the Wigmore Association in 2017, we met with a high ranking official at the Bank of Japan. He told us that they would absolutely not raise rates until they stared inflation in the face.

Japan’s reversal supports my forecast of a higher global interest rate and inflation environment. That doesn’t mean runaway inflation or weak capital markets, but the prolonged period of low interest rates is almost certainly over. Investors will have to think differently in this new environment, though we believe a high reliance on equities remains a viable strategy for long-term investors in the face of modestly higher inflation.

Dollar Outlook Bodes Well for Non-US Assets, Commodities and Energy

The US dollar has been on a tear and we believe it is overvalued in light of US debt and fiscal spending. Dollar strength continues to hamper non-US assets. It’s been over 10 years since I first predicted non-US assets would return to favor. I’m still optimistic, but my tombstone might say, “Died waiting for non-US assets to come back.”

On paper, the dollar should weaken due to the fundamental mismatch between what we spend as a country and what we require borrowers to pay. That has not been the case. Since August 2023, the dollar has been stronger and the global appetite for US Treasuries has been hearty. There are reasons for that, including steps Secretary Yellen took to limit the supply of long-term bonds. While those steps improved Treasury market dynamics by supporting demand and keeping yields lower, they also moved the US to shorter-term debt in a rising interest rate environment. That’s similar to choosing an adjustable-rate mortgage when future rates are likely to be higher.

Also notable is the Fed’s apparent willingness to cut rates this year even though it’s highly unlikely inflation will be at its 2% target. Over time, the combination of rising deficits, shorter-term US debt, and the Fed’s acquiescence to higher inflation should weaken the dollar and could finally give international assets their due. A weaker dollar would also be favorable for commodities, particularly energy.

As an aside, the rise of AI could be a significant boost for the commodity complex. The energy needed to power AI is exponentially larger than what it takes to mine bitcoin and, in my view, more than can be provided by wind and solar. This is a development that bears watching.

Low Probability Events Pose Some Risk

With equities at such high levels, we have to ask, what could derail the market’s advance? It probably won’t be the economy. Of the possible economic indicators, the inverted yield curve stands alone in signaling a recession. And AI is likely to boost economic activity, not dampen it. Future Fed action also seems likely to be benign, if not favorable, to risk assets.

Though we anticipate higher global inflation, that’s not necessarily a negative. We tend to be fans of equities when we expect inflation to be modest or more than modest because equities, commodities and real assets typically perform well in inflationary environments.

Since COVID, there has been much talk of deglobalization and potential effects on the world economy and capital markets. Although geopolitical tensions are high, I don’t think deglobalization is actually happening as much as a shift away from China, which is likely to be shunned as an investment partner until its government changes its policies. Fear that a deglobalization trend will negatively affect equity returns is overblown, in my view.

We are mindful that a major geopolitical surprise could unsettle capital markets. Potential hot spots include conflict between Taiwan and China, escalation of existing situations in the middle East and Europe, or some unforeseen coup or military action. Such geopolitical events could complicate the investment outlook, but we believe these are low probability risks and certainly nothing to discourage long-term investors from participating in the markets.

It’s been an amazing 10-12 years as equities benefited from the low interest rate environment. Though I doubt markets can match those results over the next decade, I am confident stocks will still perform well. I do worry that investors may overreact to negative events.

To further guard against the vicissitudes of the public markets, we are incorporating more private equity into Pitcairn portfolios. We believe this positioning will also help us capitalize on opportunities from AI-related startups and future innovation, where much of the potential reward will happen on the private side.

Conclusion

It is impossible to reflect on the outlook for equities and discount the importance of AI. The current buzz surrounding weight loss drugs from Novo Nordisk and Eli Lilly may pale in comparison to how AI revolutionizes medicine. We could see a similar impact across multiple industries. This really looks like an inflection point for humanity, with potential for exceptional investment returns.

That said, this is an emotional, momentum-driven market. Emotional markets will inevitably turn and it’s almost impossible to predict when they will. There might not be a US equity pullback until after the November election or perhaps not until next year, but it will happen. The key is to keep thinking long-term.

The beauty of strategic investing is that diversified portfolios will take major steps forward in this type of environment. When the S&P 500 Index returns more than 10% in a single quarter, Pitcairn clients capture the lion’s share of those gains. There’s no timing needed and that’s important because timing is going to be harder and harder. Market timers are wondering whether today’s market is like 1996 with three more years to rise or 1999 on the verge of a significant step down in technology values. Strategic investors don’t have to ask those questions because their portfolios are designed for the long term and positioned to move forward under either outcome.

Disclaimer: Pitcairn Wealth Advisors LLC (“PWA”) is a registered investment adviser with its principal place of business in the Commonwealth of Pennsylvania. Registration does not imply a certain level of skill or training. Additional information about PWA, including our registration status, fees, and services is available on the SEC’s website at www.adviserinfo.sec.gov. This material was prepared solely for informational, illustrative, and convenience purposes only and all users should be guided accordingly. All information, opinions, and estimates contained herein are given as of the date hereof and are subject to change without notice. PWA and its affiliates (jointly referred to as “Pitcairn”) do not make any representations as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether referenced or incorporated herein, and takes no responsibility thereof. As Pitcairn does not provide legal services, all users are advised to seek the advice of independent legal and tax counsel prior to relying upon or acting upon any information contained herein. The performance numbers displayed to the user may have been adversely or favorably impacted by events and economic conditions that will not prevail in the future. Past investment performance is not indicative of future results. The indices discussed are unmanaged and do not incur management fees, transaction costs, or other expenses associated with investable products. It is not possible to invest directly in an index. Projections are based on models that assume normally distributed outcomes which may not reflect actual experience. Consistent with its obligation to obtain “best execution,” Pitcairn, in exercising its investment discretion over advisory or fiduciary assets in client accounts, may allocate orders for the purchase, sale, or exchange of securities for the account to such brokers and dealers for execution on such markets, at such prices, and at such commission rates as, in the good faith judgment of Pitcairn, will be in the best interest of the account, taking into consideration in the selection of such broker and dealer, not only the available prices and rates of brokerage commissions, but also other relevant factors (such as, without limitation, execution capabilities, products, research or services provided by such brokers or dealers which are expected to provide lawful and appropriate assistance to Pitcairn in the performance of its investment decision making responsibilities). This material should not be regarded as a complete analysis of the subjects discussed. This material is provided for information purposes only and is not an offer to sell or the solicitation of an offer to purchase an interest or any other security or financial instrument.