-

Who We Are

Who We Are

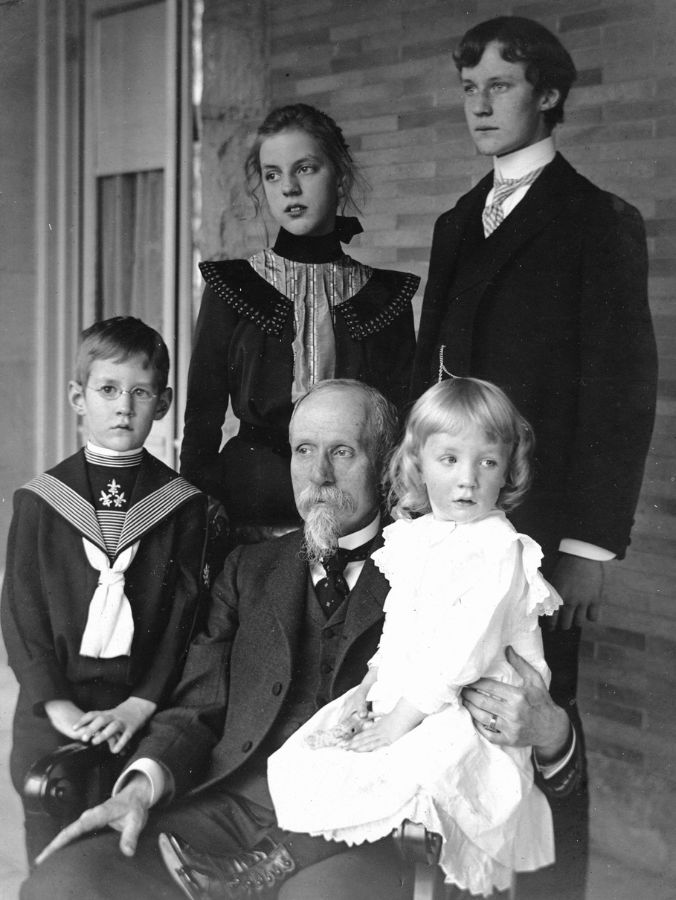

For the last century, we’ve dedicated ourselves to empowering families like yours to prosper and endure. Like many of the leading families we serve, we have been through our own wealth journey.

Discover Pitcairn -

What We Do

Wealth Momentum®

The families we serve and the relationships we have with them are at the center of everything we do. Our proprietary Wealth Momentum® model harnesses the most powerful drivers of financial and family dynamics, maximizing the impact that sustains and grows wealth for generations to come.

Explore - Insights & News

Do you own hundreds or thousands of shares in a single company that have appreciated since you acquired them? This might seem like a great position to be in—and of course, it is.

Holding a concentrated position in low-basis stock also poses several challenges related to investment risk and taxes. Here are some of your options for lowering your risk while doing the most good with your gains, whether that means giving to a worthy cause, keeping the money in the family, or both.

Give it Directly to Your Favorite Charity

How it works: Donate your low-basis stock to charity (without selling it first).

Pros: Gifting low-basis stock to charity removes it from your taxable balance sheet while allowing you to accomplish a gifting objective or fulfill a charitable pledge. You’ll get a tax deduction for your donation, and the charity will be able to sell the stock without incurring a tax bill.

Cons: If you were earning dividend income from the stock, you’ll lose that source of revenue.

Set Up a Charitable Trust

How it works: Give the stock directly to a charitable trust, a type of irrevocable trust. With a charitable lead trust, you select one or more charities to receive income for a number of years. Whatever is left at the end of the trust term goes to you, your family, or another noncharitable beneficiary.

With a charitable remainder trust, the beneficiary receives an annuity-type benefit for a number of years, and a charity gets the remaining assets.

Pros: A charitable trust allows you to preserve some of the wealth from your low-basis stock for yourself and your family while accomplishing a gifting objective. You may reduce your income tax or estate tax liability as well.

Cons: Trusts can be complicated and expensive to set up and administer.

Put It In a Donor-Advised Fund

How it works: Gift your low-basis stock to a donor-advised fund (DAF). (You can also direct charitable trust assets to a DAF.)

Pros: Contributing to a DAF is simple. A DAF allows you to choose multiple charities to benefit from your gift. It also lets you postpone deciding which charities to give to if you need time to do some research.

Cons: Again, if you were earning dividend income from the stock, you’ll lose that source of revenue.

Sell It Now

How it works: Sell all your low-basis stock immediately.

Pros: Selling your stock is easy and increases your liquidity. It locks in your gains and eliminates your risk of losing wealth if the stock’s value declines.

Cons: You’ll realize a big gain in your taxable estate in a single year. Assuming you’ve held the stock longer than one year, you’ll owe federal capital gains tax at rates of 15% or 20% depending on your taxable income. You’ll also likely owe a 3.8% net investment income tax. Most states tax capital gains, too.

Gift It To a Family Member In a Lower Tax Bracket

How it works: Gift your low-basis stock, without selling it first, to a relative with far less income than you.

Pros: Gifting your stock to a relative keeps the wealth in your family. Your gift can help the next generation—or, if you’re newly wealthy, the older generation.

Cons: This strategy may not be helpful if you’re not the first generation to hold wealth in your family. If your relatives are receiving family business or trust income, they may be subject to the same tax rates you are.

Hold It Until You Die

How it works: Do nothing and leave your low-basis stock to your heirs.

Pros: You’ll continue to receive dividends, and you’ll leave something for your heirs. They’ll benefit from a tax provision called stepped-up basis.

A step-up in basis means that if each share is worth $1,000 on the day you die, whatever profit or loss your heirs see from selling the stock will be calculated from $1,000—not its value when you acquired it (presumably much lower than $1,000). In other words, they won’t have the capital gains tax bill you would if you sold your low-basis stock tomorrow.

Cons: The stock’s value could drop between now and then. Plus, this option doesn’t eliminate your investment risk, only your tax risk—and that’s only if the law doesn’t change. Congress could one day eliminate the stepped-up basis provision, as President Biden proposed in 2021.

Swap Asset From a Grantor Trust

How it works: If you hold low-basis stock in an irrevocable trust set up as a grantor trust, it won’t get a step-up in basis when you die. That’s because you don’t own the stock, the trust does.

However, you can swap assets in a grantor trust. Take the low-basis stock out of the trust and put it back in your name and replace it by giving higher-basis assets with the same market value to the trust.

Pros: This strategy can spare heirs potential capital gain taxes when the grantor passes away and receives a step-up in basis on the assets.

Cons: This strategy may be less useful for someone in good health.

Final Thoughts

At Pitcairn, our first choice for clients with a large position in a low-basis stock is to evaluate a client’s charitable goals. However, we recognize that individual circumstances warrant customized solutions. When you’re ready, we’re here to help you explore ways to reduce your tax and investment risks.