-

Who We Are

Who We Are

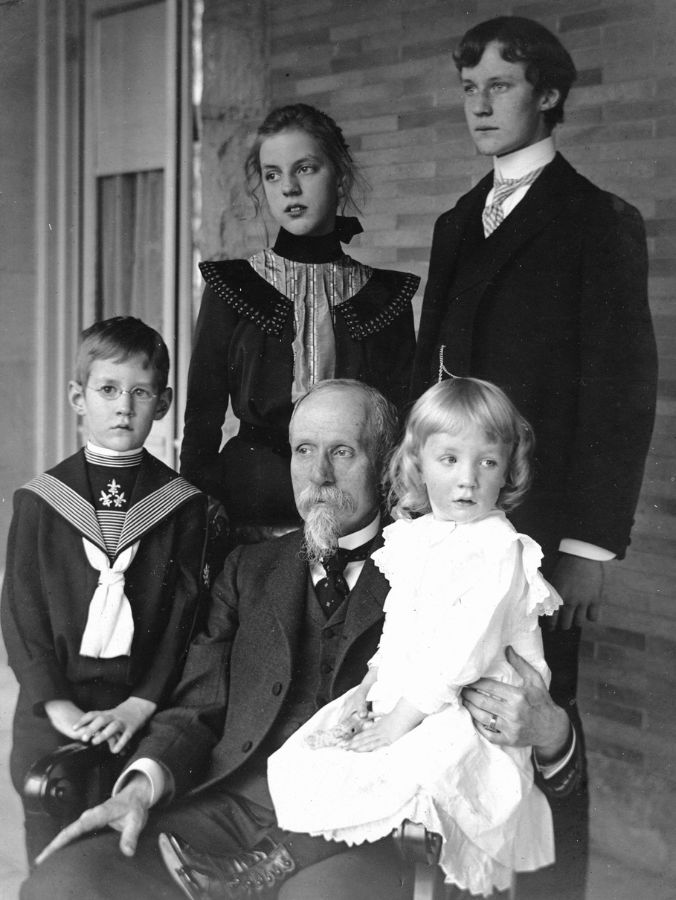

For the last century, we’ve dedicated ourselves to empowering families like yours to prosper and endure. Like many of the leading families we serve, we have been through our own wealth journey.

Discover Pitcairn -

What We Do

Wealth Momentum®

The families we serve and the relationships we have with them are at the center of everything we do. Our proprietary Wealth Momentum® model harnesses the most powerful drivers of financial and family dynamics, maximizing the impact that sustains and grows wealth for generations to come.

Explore - Insights & News

It’s summertime and the livin’ is easy. This summer, before you host any special events at your home, plan extended travel or buy a new vehicle or watercraft, make sure your insurance has you covered.

Summertime is Party Time

Weddings, anniversaries, graduations or any other type of get-together — summer is prime time for both celebrations and impromptu gatherings — and when the weather is nice, entertaining often moves to the backyard. Guest lists expand and outdoor activities multiply. Every special event has a long to-do list, but before you book a caterer, make sure you’re fully covered for any specialty outdoor equipment or activity.

For example, a pool can be a wonderful amenity for your backyard, adding aesthetic value and plenty of opportunities for relaxation and all-around fun. But pools also come with increased risk of liability so it’s important to have the right safety measures and the right insurance in place. This also applies to other backyard equipment with risk of injury, such as a trampoline or playful bounce houses for the kids or horseshoes and other games for the adults. In many cases, an umbrella liability insurance policy already in place may be all you need, but it’s always a good idea to touch base with your insurance company before you host a large event at your home. Some situations may call for a little extra planning or protection.

Keep Those Big Wheels Turning

When the open road calls — as it often does in summer — insurance is key to a smooth ride no matter how many wheels are rolling along beneath you. Anytime you purchase or rent a vehicle, whether a car, motorcycle, or RV, determine whether you are covered by your current automotive policy or if you’ll need additional or different coverage. Certain circumstances can require special attention, for example, driving your car outside the US or renting a unique vehicle such as a classic/collector car or a snazzy sports car.

Check Your Coverage and Enjoy Smooth Sailing Ahead

Boat insurance varies by the type and size of the boat and where you dock it. If you own your own boat, we probably confirmed that you have appropriate coverage at your last annual insurance review. However, if you intend to add any watercraft to your fleet, whether a sailboat, motorboat, or jet ski, let us know right away so we can update your coverage. And, if you plan to rent any watercraft, let us confirm you are covered either by your own policy or a rental policy. Floating a boat can involve particular considerations such as how you use it — for example, whether you tow skiers or tubes.

Insuring Your Travel AND Protecting Your Health

Travel picks up in summer as schools are out and our hectic pace settles down a bit. There are two kinds of insurance protection you may want to arrange when you schedule a trip. The first is travel insurance. Depending on the specific policy language, travel insurance typically provides monetary compensation for trip cancellations, travel delays, lost or delayed luggage, etc.

A separate but equally important consideration for travelers is health insurance, particularly if your trip is outside the US. Health insurance designed for travel outside of your home country helps to keep you safe and get you home should you become ill or injured. Travel health insurance varies depending on where and for how long you will be traveling as well as the scope of coverage you prefer.

It’s important to understand the difference between travel insurance and travel health insurance and to be sure you have policies suited to your needs.

Do You Need Extended Protection for Your Extended Vacation?

Vacations are synonymous with summer and everyone has their own vision of the perfect R&R. Even if you own a vacation home, you may decide to rent for a change of scenery. Generally, belongings you take to a vacation rental are automatically covered by your homeowner’s policy. However, for longer term rentals, of a month or more, it may make sense to notify your insurance company and extend your liability policy to the rental property. The location of your rental is also a consideration in your coverage. If you opt for a rental when traveling outside the US, you should notify your insurance company to be sure you are adequately covered.

At Pitcairn, we understand that insurance is integral to comprehensive wealth planning. Now, more than ever, with climate risk and other weather-related issues driving up insurance premiums everywhere, it’s always a good practice to check your coverage.

For clients who coordinate their insurance through us, we conduct annual reviews to be sure policies are up-to-date and attuned to current needs. However, change doesn’t happen just once a year. Let us know when life changes, so we can proactively adjust your insurance when and where needed. If you would like to schedule an insurance review, please give us a call to schedule a personalized consultation.