-

Who We Are

Who We Are

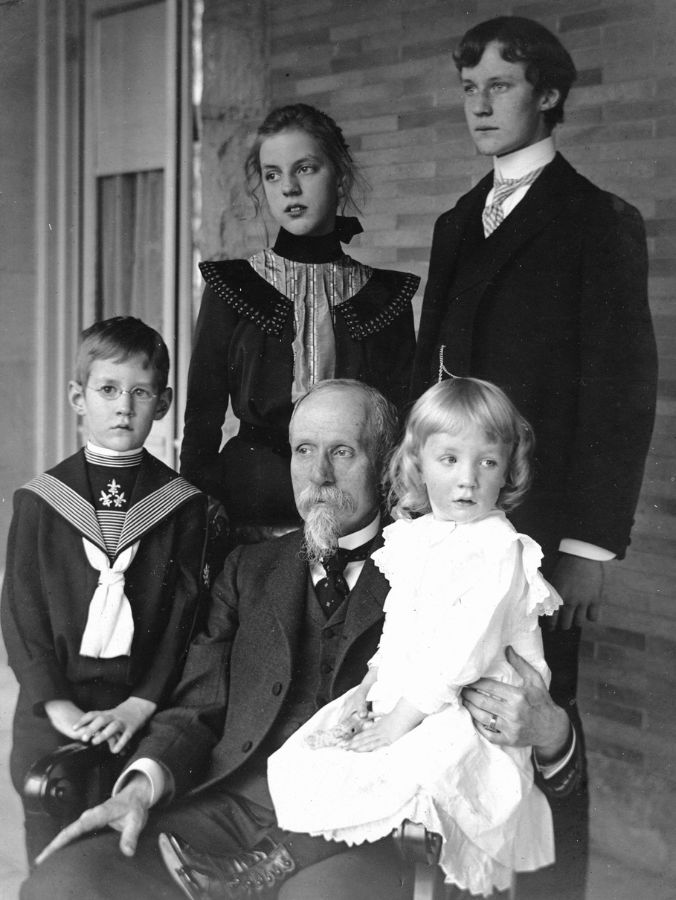

For the last century, we’ve dedicated ourselves to empowering families like yours to prosper and endure. Like many of the leading families we serve, we have been through our own wealth journey.

Discover Pitcairn -

What We Do

Wealth Momentum®

The families we serve and the relationships we have with them are at the center of everything we do. Our proprietary Wealth Momentum® model harnesses the most powerful drivers of financial and family dynamics, maximizing the impact that sustains and grows wealth for generations to come.

Explore - Insights & News

Nathan Sonnenberg has walked many paths in the financial services industry, the most recent of which has brought him to Pitcairn where he now serves as our Chief Investment Officer.

Growing up in Massachusetts, Nathan’s first exposure to investments came when his father advised him to invest most of his bar mitzvah gifts. “This advice sparked a discussion about mutual funds and the beginning of my interest in investing,” explains Nathan. Though his fascination with investing continued, he took a slight detour before ultimately pursuing his passion.

When it came time for college, Nathan’s family had relocated to Virginia, and he enrolled at the University of Virginia School of Engineering. “I had a strong background in math and science so I thought I would be a computer scientist.” But two years in, he realized coding wasn’t his passion and switched majors to systems engineering. “I describe systems engineering as the interdisciplinary field marrying business strategy, optimization, and engineering management. For example, imagine a newly designed ski resort. That developer has to plan the placement of the ski lifts, where to cut the trails, and how many lodges to build for a smooth, profitable flow of people on the mountain.”

Systems engineering led to a position as a management consultant. All the while, Nathan kept up his interest in the stock market. “Investing is all about the exciting intersection between businesses, market strategy, product development, investor psychology, geopolitics, and economics. Investing encompasses virtually everything happening across our economy.”

With encouragement from a friend who was a grader for the Chartered Financial Analyst (CFA) exams, Nathan began the difficult process of becoming a CFA charter holder, which jump-started his financial services career. He has been deeply involved in investments and directly serving clients since 1996. “I am passionate about what I do because I find it fascinating on many levels. For me, investing is like one, giant, multidimensional puzzle.”

Witnessing the Evolution of Wealth Management

Throughout his 27-year career, Nathan has held leadership positions, including chief investment officer, at wealth management firms Fortigent, AdvicePeriod, Glassman Wealth Services, and Abbott Downing. Before joining Pitcairn, Nathan founded Wealth Management Consulting, an outsourced-CIO consultancy firm.

“We have known and worked with Nathan for many years,” says Rick Pitcairn, Chief Global Strategist. “As far back as 2007, when he was CIO of Fortigent, Nathan helped Pitcairn implement our successful open architecture platform. We know he is a smart and highly experienced investment professional and have seen firsthand that he shares our values and commitment to doing what’s best for families of wealth.”

During more than a quarter century in financial services, Nathan has witnessed the evolution of wealth management from retail to institutional, a transition that yielded both positive developments and greater complexity. “Being part of that evolution has been beneficial, as I’ve had a bird’s-eye view and have observed what worked and what didn’t — the successes and the failures.”

Simplifying Complex Concepts

Another advantage for Pitcairn clients is that Nathan has worked exclusively on the taxable side of investment management. “People who are taxed on their assets have a very different perspective than foundations and endowments, which aren’t. I understand that Pitcairn’s strategies for client assets must consider the nuances of estate planning while gauging tax efficiency and the potential returns net of fees.”

Leslie Voth, Pitcairn’s Chairman, CEO, and President, believes Nathan’s emotional intelligence will also add value for the firm’s clients. “Nathan talks to people in a way that connects to things they value or experiences they have lived. He uses analogies very effectively to simplify even the most complex concepts,” says Leslie. “These skills will be instrumental as he sits side by side with Pitcairn clients to help them understand our strategies for their investment portfolios.”

Having worked closely with Pitcairn over the years, Nathan gained valuable insight into the organization even before he came on board. What made him want to be part of the Pitcairn team? “First,” he explains, “there is the extraordinary focus on service. The belief that clients come first is deeply embedded in Pitcairn’s DNA, going back to its early days as a single-family office. Second, is the culture, particularly the mutual respect among professionals, the strong focus on team building, and the emphasis on continuity of relationships. The positive effects of this culture are evident in the number of employees who have been here 10, 20 years or more. People feel part of something different and special and want to be part of the continued success here. I want to be part of and contribute to that continued success.”

Q & A WITH CHIEF INVESTMENT OFFICER NATHAN SONNENBERG

Your resume is packed with experience. How does your prior experience bring value to Pitcairn’s clients?

“Wealth management has evolved from a retail orientation to an institutional focus, resulting in many positives and greater complexity. For example, performance reporting used to be opaque but is now more comprehensive and transparent. At the same time, family portfolios previously relied mainly on stocks and bonds for wealth building. However, as the array of investments has broadened to include hedge funds and private capital, portfolio construction has become a much more sophisticated endeavor. Having witnessed this evolution over time, I saw what worked and what didn’t — the successes and the failures — which deepens my understanding of the investment landscape.

Another aspect of my experience that specifically benefits Pitcairn clients is that I have worked exclusively on the taxable side of investment management. I have served high-net-worth families and individuals my whole career. That’s important because people whose assets are taxable have a very different perspective and require different strategies than pensions, endowments, and foundations. For effective multigenerational wealth building, managers have to appreciate the nuances of estate planning techniques and the necessity of evaluating potential investments in terms of tax efficiency as well as returns gross and net of fees.

Real-world experience hones our abilities in ways that are hard to replicate. For example, I worked in the investment industry through the technology and internet boom of 1995–2000, the subsequent 2001–2003 bear market, and the ascendance of emerging markets with the rise of Brazil, Russia, India, and China, collectively dubbed the “BRICs.” In the last 15 years alone, we have been tested by the 2008 global financial crisis, a global pandemic with COVID, and, most recently, the reemergence of inflation for the first time in decades.

While each period has its own narrative, nothing can replace the experience of having lived and worked through it. I feel blessed to have earned my stripes in a series of incredibly diverse investment periods.”

What challenges does the current investment environment pose for families, and how can Pitcairn help them capitalize on opportunities?

“Today’s investment environment is very different from what we experienced over the last decade and a half. The fifteen-year period from 2008 to 2021 was characterized by central bank intervention and the collective willingness of the Federal Reserve, the European Central Bank, and the Bank of Japan to flood global financial markets with liquidity, pushing down interest rates and encouraging economic growth. This stimulus forced investors away from safe investments like bonds and cash because U.S. Treasuries yield almost nothing, and cash actually paid you nothing.

While central banks were suppressing interest rates, inflation was kept at bay by China’s emergence as a manufacturing powerhouse, which exported disinflation to the rest of the world. The result was one of the longest periods of price stability we have ever known.

Faced with low investment yields, investors moved into more risky investments, from investment-grade and non-investment-grade (high-yield) debt and into equities: dividend-paying, core, and growth stocks. Markets focused most on fast-growing companies, while low inflation and interest rates allowed for the highest valuations we had seen over the previous 20 years. Equity investors enjoyed massive gains.

Thanks to COVID, inflation, and dramatic demographic trends, that environment no longer exists. China is now realizing the negative effects its one-child policy will have on future growth, and aging populations in Japan and Europe will also limit labor availability. A reversal of 30+ years of globalization is also underway and will likely have significant, negative ramifications. COVID turned the spotlight on supply chains and other trade risks, causing companies and countries to rethink pro-global policies. As a result, we are seeing more onshore manufacturing and a shift from “just-in-time” to “just-in-case” inventory management.

New market regimes create challenges as well as opportunities. The rewards will accrue to those who are paying attention and realize that changes are afoot.

At Pitcairn, we are evaluating the potential short-, intermediate-, and long-term effects of these changes and determining whether they alter any assumptions embedded in our current portfolios. We want to identify potential opportunities and risks as early as possible.

For example, if countries are leaning toward nationalization of resources, should portfolios have different exposures to materials, industrials, or energy? Will increased attention on the market dominance of large tech companies and oligopolies affect some of the more valuable large index companies? More broadly, should portfolios have more explicit exposure to areas that we believe have tailwinds, and vice versa for those with headwinds? These are questions that we as prudent investors will focus on.”

Building the firm’s long-term capital framework is very important. What areas will you focus on?

“Let me highlight three areas of focus for the near term: private capital, alternative investments, and risk management. Within the private capital universe, categories include private equity, private debt, real estate, infrastructure, timber, and land (agriculture).

Private capital used to just be buyouts, but it continues to evolve in terms of asset types, deal timing, access points, and deal structures. Back in the day, private capital sponsors would invest early in a company’s life cycle and take it public at the small- or mid-cap size range. Over the last decade or so, sponsors have been keeping companies private longer, with greater potential reward for private investors. If companies grow from $1 billion to $50 billion before going public, those gains go to private investors. There’s also been a lowering of investment minimums, expansion in the types of structures, and increased access to deals through the secondary market.

Pitcairn and its clients are especially attractive to the preeminent private equity firms, as these organizations want truly long-term investors. These are a few examples of how private capital is evolving, and why it may be worthwhile to bolster our resources in this area.

When we talk about alternatives, we mainly mean hedge funds that exist in a limited-partner structure. In our portfolios, we look for solutions that deliver higher returns than bonds and lower returns than stocks and have significantly reduced price volatility and much smaller projected drawdowns in periods of stress.

One of the most important characteristics we look for is less sensitivity to broad equity markets and low correlations to other components in client portfolios. In addition, we seek hedge funds that can hit consistent singles and doubles while complementing clients’ existing fixed-income and equity positions. Hedge funds are not a new area for Pitcairn, but one where expanding opportunities may call for increased attention.

The third area of focus is risk management. First, we will look closely at how we think about risk and ask probing questions. What does risk mean for each client? Is it volatility, potential downsides, or the risk of running out of money? Second, we will consider the tools we use, or might use, to capture and measure risk in a way that is most meaningful to our clients. Are the tools we have historically used still effective, and are there tools we can add to our toolbox to measure risks within portfolio structures and evaluate managers across asset classes?

What we learn will factor into the building of optimal portfolios for specific client risk tolerances. We want to be sure that all clients have the right portfolio structure for their preferred risk tolerance and that we can articulate the risk in a way clients understand.

More broadly, we will be looking at the types of investment solutions we use and whether varying or adding solutions might improve tax efficiency while also leveraging management skill.

The nature and structure of equity markets have evolved over the last 15 years or more. In particular, the expansion and evolution of the ETF market has increased opportunities in index-type vehicles. I strongly believe that our open architecture platform works in our clients’ best interests and that using both active and passive managers optimizes long-term portfolio performance. One of our goals is to ensure that we combine passive/index exposures with active exposures in the most effective, tax-efficient manner.”

How do you interact with Pitcairn client families and help them progress toward their long-term goals?

“I work very closely with Pitcairn relationship managers and clients whenever I can add value. My responsibility is to clearly explain our investment approach, present risks and opportunities in the market, and show how they directly affects clients’ specific allocations and exposures. I want to make our clients comfortable and confident in what we are doing from the investment side, in unison with what is done in terms of trusts, estate planning, and other aspects of our Wealth Momentum® experience. Ultimately, the investment team is charged with constructing robust portfolios and ensuring that clients feel confident they will achieve their goals. I give clients the time to ask questions and learn whatever they need to build trust in us and confidence in our approach.”

What makes you especially optimistic about Pitcairn’s future and the continued success of our clients?

“What stands out to me is that this century-old firm always puts clients first. Also distinctive are the tremendous internal culture, the mutual respect among its professionals, the intense focus on team building, and the emphasis on continuity of relationships. Pitcairn understands where we are truly expert and where we can leverage outside expertise consistent with our values and culture.

I would also say there is an intentional effort to be patient and methodical. An organization celebrating its 100th anniversary has substantial experience playing the long game. That history alone means the organization has been willing to change, grow, and evolve.

One thing that impresses me about Pitcairn is that changes are not made reactively, but rather through an intelligent, collaborative, disciplined approach. Ultimately, this is likely to have positive long-term results for Pitcairn and its clients.”

About Pitcairn

Pitcairn’s unique Shared Single-family Office™ model provides unparalleled service to wealthy families and other family offices. With a heritage dating back to the firm’s founding in 1923, Pitcairn has a long-standing tradition of helping ultra-high-net-worth families navigate the complexities of wealth and plan for the future. The firm’s comprehensive services include investment advisory, wealth management, tax, trust and estate planning, risk management, accounting, and household-level financial services as well as family education and family governance support. The firm is headquartered in suburban Philadelphia, with offices in New York, suburban Washington D.C. and a presence in Florida.