-

Who We Are

Who We Are

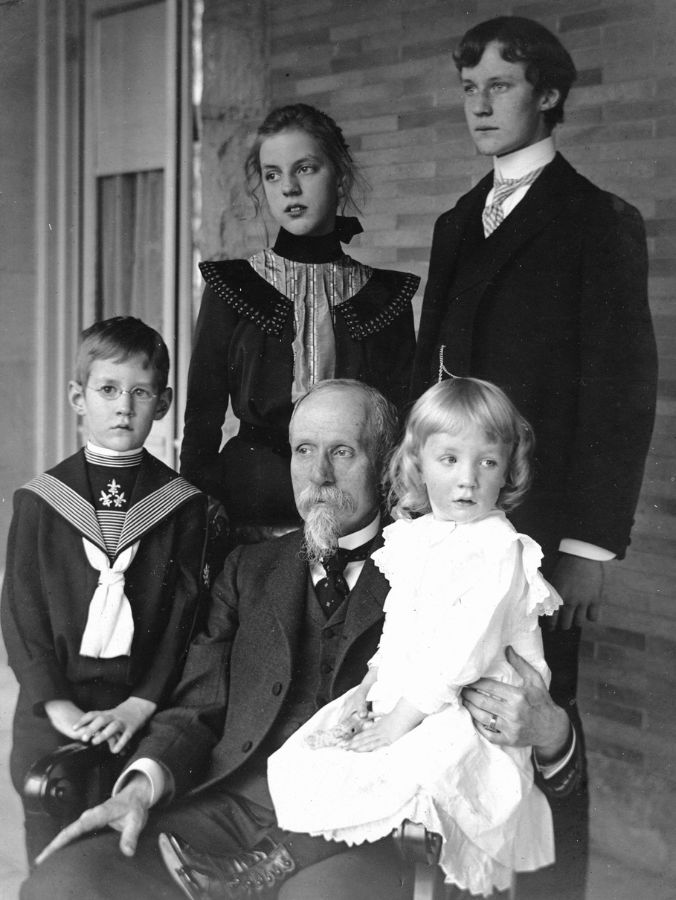

For the last century, we’ve dedicated ourselves to empowering families like yours to prosper and endure. Like many of the leading families we serve, we have been through our own wealth journey.

Discover Pitcairn -

What We Do

Wealth Momentum®

The families we serve and the relationships we have with them are at the center of everything we do. Our proprietary Wealth Momentum® model harnesses powerful drivers of financial and family dynamics, maximizing the impact that sustains and grows wealth for generations to come.

Explore - Insights & News

Key Takeaways

- AI-driven momentum continues to power markets, overwhelming concerns about deficits, tariffs, and political dysfunction.

- Diversification and discipline — across geographies and asset classes — were rewarded for the first time post-COVID, making cautious conviction more fruitful than riding a single trend.

- Market froth and elevated valuations urge readiness for a typical pullback, particularly as geopolitical and policy dynamics remain volatile.

- Investors must resist letting partisan politics dictate their portfolio positioning; history shows that wealth grows through adaptation, resilience, and a long-term perspective.

Polarization to Productivity

The third quarter was marked by polarization — not just on cable news, but across the entire financial landscape. At our recent gatherings, I found myself returning to the theme, “Meet me in the middle.” Why? Because while one camp is stocking up on gold bars and freeze-dried rations, certain that the fiscal sky is falling, another is already counting their returns from an AI-fueled renaissance. The reality, as always, resides somewhere in between.

Think back: When has the world not felt like it was teetering on some precipice? The Vietnam era? The inflation shocks of the seventies? Reflecting on the din around government shutdowns, fiscal cliffs, and Federal Reserve policy, I’m reminded that this is the way markets behave. The news moves from one crisis to the next. The data — GDP clipping at 3%, far above spring’s gloomy predictions, and earnings surprising to the upside — tell a more balanced story.

Opportunity, then, lies not in the extremes, but in recognizing how recurring narratives — be they policy missteps or technological triumphs — reframe risk. The bull market shrugged off political drama and government shutdowns. The third quarter, logged 23 new S&P 500 price records and saw the strongest September since 2010. That’s momentum.

Equity Momentum Powers Strong Third Quarter

Momentum was the defining force of the third quarter. The S&P 500 rose approximately 8%, with the Nasdaq advancing over 11% and small-cap stocks leading with a 12.4% gain for the third quarter. Far from a narrow leadership, gains broadened meaningfully to international stocks, gold, and infrastructure. This is a rare yet healthy sign that prudent diversification—not just chasing the Mag 7—has paid off in real dollars. Historically, momentum has persisted for several quarters, and seasonality into year-end remains constructive. US equity valuations are elevated. We view valuations as squarely in the “overweight but not morbidly obese” camp. Long-term investors should prepare for the normal corrections that pave the way for continued advances. As I’ve often said, a five- to ten percent retreat is both healthy and probable in extended bull markets. In fact, it is normal for the market to experience meaningful drawdowns and still end the year in positive territory.

Earnings in the third quarter of 2025 provided a sturdy tailwind for markets and served as a primary driver for broad-based gains across asset classes. Consensus estimates, which had been dialed back as recently as spring due to fears of stagflation and tariff-induced economic drag, were repeatedly revised higher as AI-driven capital spending turned into visible top-line and earnings growth for US companies

US Policy and Economic Backdrop

What truly set this quarter apart was the market’s stoic response to policy and political fireworks. The third quarter brought an escalation and resolution in Israel-Iran tensions, ongoing hostilities in Russia and Ukraine, persistent friction with China over trade and technology, and now we find ourselves in the middle of a US government shutdown. It’s worth noting that the market has mainly priced in Washington’s dysfunction and the noise of political cycles—a significant shift in psychology that, for now, favors discipline over reaction.

The Fed took the first rate cut of 2025 in September. Chairman Jerome Powell’s decision was well-received by markets, helping to nudge the 10-year Treasury toward a friendlier low-4% range and supporting asset prices across the board. Still, the Fed’s hand is hardly free. Persistent political pressure from the administration, particularly regarding the need for easier policy to offset tariff-induced inflation and support economic growth, has only heightened scrutiny of central bank independence. The Fed is inclined to cut further, but the path ahead remains data-dependent and sensitive to inflation impulses and headline risks.

Fundamentals

Fiscal dynamics in 2025 continue to tug headlines in two directions. On one side, legislative action—namely, the “One Big Beautiful Bill,” with tax cuts and R&D expensing—has injected renewed stimulus into the economy, propelling GDP and supporting above-trend earnings. On the other hand, the persistent gap between spending and revenue remains a central risk theme.

Across macroeconomic data, consensus GDP outlooks continued to be revised upward, with the Atlanta Fed’s model tracking growth above 3%. Inflation, while not vanquished, is softening in the real economy. Headline and core inflation readings eased from peaks observed in the previous years. Goods inflation largely faded as supply chain pressures were resolved, but services inflation, especially in sectors driven by shelter and wages, remained somewhat sticky, even as the pace of increase slowed. Broader monetary factors—such as persistent US deficit spending and central bank liquidity—continue to provide support to asset prices, while also reinforcing sustained (if declining) inflationary impulses in the system. The consensus baseline is for inflation to continue receding toward the target, but some upside risk persists, especially if labor markets remain tight or geopolitical energy shocks reemerge.

There is some expectation that the labor market may cool modestly heading into 2026 as momentum slows. Still, the consumer foundation remains intact for now, and no sudden spike in joblessness has materialized. Consumption, particularly in the upper quartiles, continues to drive GDP, while discussions around fiscal rebates and policy support point to potential tailwinds in early 2025.

AI and Optimism

In many ways, AI stands as both the engine and emblem of the current climate. From a capital markets perspective, AI infrastructure investment and earnings growth set the pace for robust returns. But AI’s influence wasn’t confined to boardrooms—its practical benefits became tangible in everyday operations. Personally, I have used generative AI to accelerate data gathering, automate repetitive research, and streamline travel logistics, allowing me to spend more time on high-value client work and big-picture thinking. The bottom line: AI was not merely a narrative, but a productivity lever increasingly visible in quarterly earnings lines.

Still, as with any boom, some misallocation is inevitable, recalling the internet bubble of the late 1990s, but with AI’s investment payoffs appearing much faster. For investors, the lesson is timeless: resist the urge to swing between extreme optimism (or pessimism). Recognize that these inflection points—where narratives diverge—are where a “meet me in the middle” mentality and portfolio discipline matter most. The historical correlation remains: optimism, grounded in purpose, can cut through any cycle.

This is the ground on which we advance: steadied by discipline, open to innovation, and aware that volatility is the price of admission for lasting growth.

Market Dynamics

Diversification among asset classes and geographies continued to truly pay off, with strong results seen across asset classes, reinforcing that patient allocation—rather than market timing or sector-chasing—remains essential in this era of fast-changing leadership.

What stands out is not just the magnitude of this quarter’s move—but its composition. The so-called “Magnificent 7” remain influential, but the tape was healthier, with a greater share of individual stocks trading above their 200-day moving averages than at any point in the last several years. In technical terms, this is a market with conviction, not just speculation

Fixed income played its stabilizing role as yields drifted lower following the September rate cut, and high-grade credit performed respectably. Private debt continued to deliver. Commodities and alternative assets, likewise, oscillated with global trade and inflation narratives, but ultimately balanced the portfolio amidst policy and geopolitical tension.

Outlook

As we look ahead to the fourth quarter and beyond, momentum remains positive, but caution is warranted. History makes it very clear: powerful runs like these rarely combust, but they do correct, sometimes without warning. Valuations across most risk assets are no longer discounted for risk, but instead reflect much of the anticipated positive news on AI, policy, and growth. It would not surprise me to see a healthy 5–10% pullback—a dynamic both predictable and ultimately beneficial for long-term investors.

Policy risks aren’t abating. With an election year ahead and global macro uncertainty—ranging from fiscal debates to international tensions—the market’s capacity to digest shocks will be tested. The Federal Reserve’s evolving stance will be a central narrative, and inflation, while tamer, is not yet vanquished. Yet, the seasonality entering year-end and the continued strength of the consumer give reason for steady optimism. Most importantly, opportunities will present themselves for those able to deploy new capital methodically when volatility returns.

Periods like this are precisely why our discipline endures. The temptation to chase performance, to let politics or headlines dictate allocations, is perennial. But wealth—true, multi-generational wealth—is not built in extremes. It is cultivated through a deliberate balance of conviction and humility, patience and readiness, policy and opportunity.

“Valuations always matter.” “History has shown this time and time again.” We say these things at Pitcairn not out of habit, but because every market cycle reaffirms them. Policies exist to guide us in times like these—when noise drowns out the signal, and the choice to act or stand pat can weigh on even the most experienced stewards.

What markets need now is not prediction, but preparation. Meet me in the middle: maintain purposeful diversification, rebalance into strength, prune excess where it arises, and remember that legacy is about more than return—it’s about resilience and the wise use of opportunity.

This is the way markets behave. And it is through prudent, values-rooted navigation that we maintain purpose, resilience, and legacy, regardless of what the next quarter brings.

Disclaimer: Pitcairn Wealth Advisors LLC (“PWA”) is a registered investment adviser with its principal place of business in the Commonwealth of Pennsylvania. Registration does not imply a certain level of skill or training. Additional information about PWA, including our registration status, fees, and services is available on the SEC’s website at www.adviserinfo.sec.gov. This material was prepared solely for informational, illustrative, and convenience purposes only and all users should be guided accordingly. All information, opinions, and estimates contained herein are given as of the date hereof and are subject to change without notice. PWA and its affiliates (jointly referred to as “Pitcairn”) do not make any representations as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether referenced or incorporated herein, and takes no responsibility thereof. As Pitcairn does not provide legal services, all users are advised to seek the advice of independent legal and tax counsel prior to relying upon or acting upon any information contained herein. The performance numbers displayed to the user may have been adversely or favorably impacted by events and economic conditions that will not prevail in the future. Past investment performance is not indicative of future results. The indices discussed are unmanaged and do not incur management fees, transaction costs, or other expenses associated with investable products. It is not possible to invest directly in an index. Projections are based on models that assume normally distributed outcomes which may not reflect actual experience. Consistent with its obligation to obtain “best execution,” Pitcairn, in exercising its investment discretion over advisory or fiduciary assets in client accounts, may allocate orders for the purchase, sale, or exchange of securities for the account to such brokers and dealers for execution on such markets, at such prices, and at such commission rates as, in the good faith judgment of Pitcairn, will be in the best interest of the account, taking into consideration in the selection of such broker and dealer, not only the available prices and rates of brokerage commissions, but also other relevant factors (such as, without limitation, execution capabilities, products, research or services provided by such brokers or dealers which are expected to provide lawful and appropriate assistance to Pitcairn in the performance of its investment decision making responsibilities). This material should not be regarded as a complete analysis of the subjects discussed. This material is provided for information purposes only and is not an offer to sell or the solicitation of an offer to purchase an interest or any other security or financial instrument.