-

Who We Are

Who We Are

For the last century, we’ve dedicated ourselves to empowering families like yours to prosper and endure. Like many of the leading families we serve, we have been through our own wealth journey.

Discover Pitcairn -

What We Do

Wealth Momentum®

The families we serve and the relationships we have with them are at the center of everything we do. Our proprietary Wealth Momentum® model harnesses powerful drivers of financial and family dynamics, maximizing the impact that sustains and grows wealth for generations to come.

Explore - Insights & News

Many Americans who travel abroad wonder what it would be like to live in a foreign country for an extended period or even indefinitely. Recently, interest in living or retiring outside the US has been increasing. For some empty-nesters, it’s an opportunity to have a grown-up version of a college study aboard experience learning a new language and enjoying a new culture. For others, it’s a chance to get back to one’s roots or research family history.

Whatever the reason, more US citizens are living outside the country. The Social Security Administration reports that the number of retirees who receive Social Security outside the US jumped 40% between 2007 to 2017, the most recent data available.

Successful people move to new countries for many different reasons — career prospects, favorable financial conditions, love and family, and often simply for la dolce vita. In the movies, life in a foreign locale often begins impulsively. Someone travels abroad and promptly falls in love with an exotic country, picturesque town, or enchanting, but rundown villa. Suddenly, they’re embracing a new life, rich with exciting adventures, comical predicaments, and a preordained happy ending.

While such movies make for a fun date night, we strongly encourage a more thoughtful approach for anyone yearning to try an expat life. We are very familiar with the rewards and requirements of living abroad. In fact, among multi-generational families of wealth, it’s common for one or more family members to live overseas. As always, we recommend a holistic approach that considers how a move would affect all aspects of your life and wealth planning. As your family office, we can help you reach for your dream while clearing any hurdles along the way.

Look First to Your Personality, Preferences, and Goals

Think about what you’re looking for in a new country. Do you see your foreign home as a base for travel or somewhere to join a community and immerse yourself in the culture?

Reflecting on questions like these will help you choose a destination and decide whether to begin with an extended stay or move full speed ahead with a longer-term relocation. There are many issues to consider, including:

- Your familiarity with the country or city. Have you spent time there recently and across multiple seasons? Do you have trusted contacts inside the country who have good local knowledge?

- Transportation accessibility. Are there non-stop flights to and from your US base? If you plan to travel while living there, how convenient are train stations and airports?

- Ease of entry (visa requirements and immigration regulations). Can you legally live and/or work there as a US citizen? Can you easily re-enter after traveling to other jurisdictions?

- The impact on other family members. How frequently would you want to see your children and grandchildren? Will your relatives have the time and resources to visit you?

- Financial considerations. Cost of living, exchange rates, tax treaties, and other factors may influence your choice of country and city, as well as the length of your stay.

We can help you systematically work through questions and issues until your plan is fully formed and ready to implement.

Establishing Legal Residence

Where you choose to live, how long you plan to stay, and whether you plan to work all factor into the process of establishing legal residency. Consult an immigration attorney to get the correct information and assistance. A number of preliminary actions can smooth the process:

- Collect documents that may be needed for immigration purposes. These include birth certificates, marriage and/or divorce papers, driver’s licenses, Social Security cards, medical and dental records, child custody papers, and children’s school records. Depending on the country, you may also be asked to provide records to demonstrate your financial self-sufficiency.

- If you have or can obtain dual citizenship, particularly in a European country, this may simplify the entry process and also allow you to move around more freely.

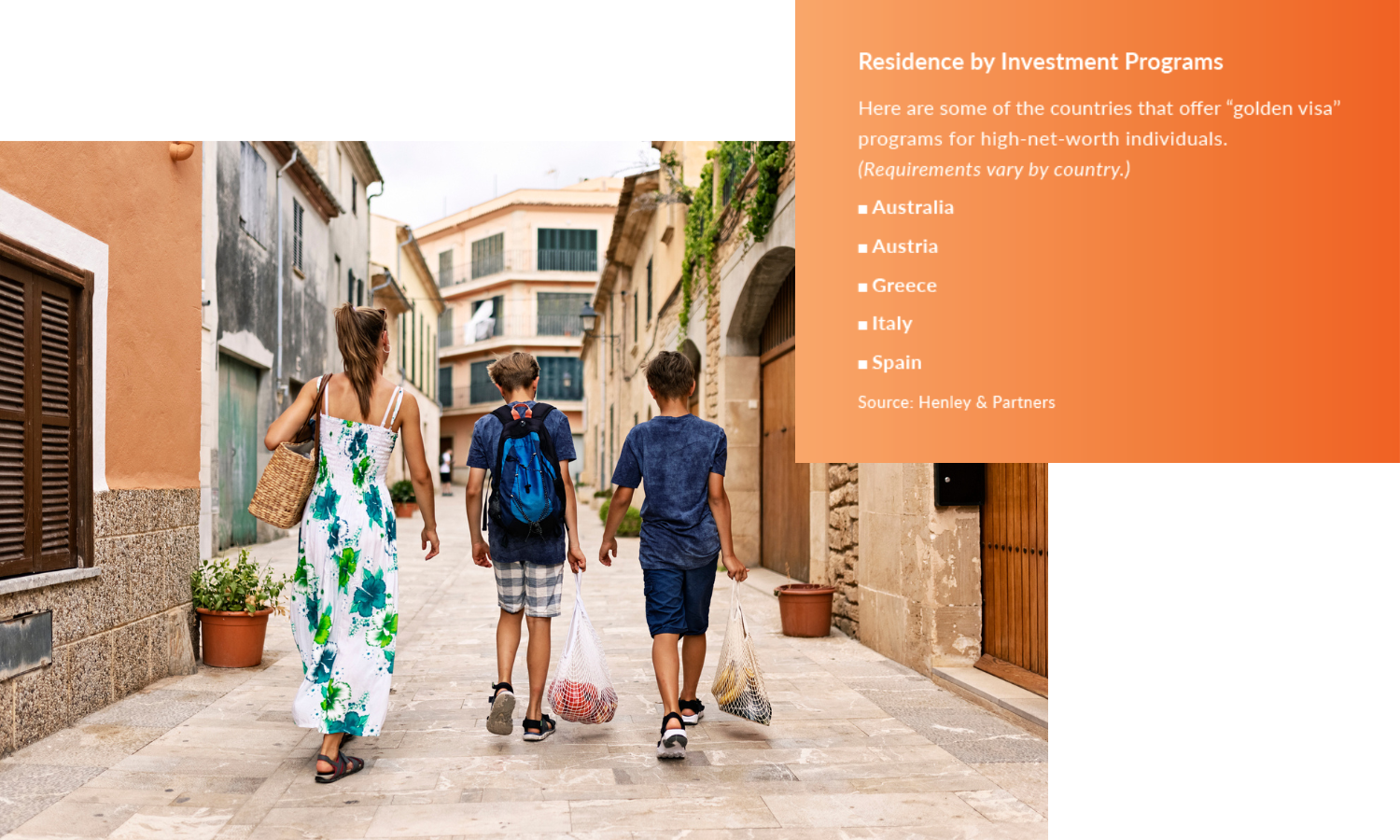

- In many countries, you can also acquire residency in exchange for purchasing real estate or making a significant investment (usually $1M+) in a company based in that country. For example, Spain and Greece offer an investor visa (called a “Golden Visa” colloquially) that provides renewable residency permits for property purchases of at least 500,000 euros.

Buy or Rent? Real Estate Considerations

One of your early decisions will be whether to purchase or rent a home while you live abroad. There are pros and cons to each and we can help you determine the better choice for your circumstances. Understanding the local market and available options is vital, so we recommend working with a local real estate agent. Considerations include:

- Conditions in the real estate market. What are the local trends? Do properties sell quickly or linger on the market?

- Exchange rates. How will the US dollar’s strength or weakness affect your buying power?

- Property management. If you need to rent out your overseas residence, who will take care of the property while you’re away? Can you find professional property management or a trustworthy and reliable local caretaker? Movies often romanticize buying a fixer-upper, but do you have the time, patience, and skill to manage a renovation, especially from afar?

- Payment options. Traditional mortgages are generally not available for foreign buyers. For cash purchases, we recommend getting reputable local advice to protect against fraud and enable a smooth title transfer.

- Community support. How welcoming are the local residents? Is there an expat community there that can help you make the transition?

If you are still testing the waters of living abroad or want to experience several countries and communities before making a final choice, renting probably makes more sense. Owning non-US property involves critical estate-related and other considerations that we highlight in the wealth management section to follow.

Families with substantial wealth typically have complex financial plans and living overseas adds yet another layer of complexity. Having worked with wealthy families for 100 years, Pitcairn understands the appeal of a global lifestyle and we are well prepared to manage the complexity in concert with international and local specialists. Living outside the US affects your budget, tax situation, investments, and ultimately your estate plan.

Budgeting and Cash Management

Before making your move, you will want to carefully consider both how your US portfolio is performing and potential changes to your living expenses. In most cases, your income is earned in dollars while your spending will now be in another currency. The US dollar’s current strength and trend will affect the cost of buying property as well as everyday living expenses. This may influence the timing and length of your stay.

Setting up access to your US funds while overseas is essential and can be challenging. Foreign banks may avoid serving US citizens due to reporting requirements. We can help you determine the best way to access cash, whether by establishing an account at a large US multinational bank with physical offices in your new country, transferring money to a local bank if possible, or using a travel credit card with no foreign transaction fees.

Taxes, Recordkeeping, and Estate Planning

Generally, US citizens and legal residents are required to pay US income tax on worldwide income, regardless of the source. Similarly, US citizens are subject to US gift and estate taxes on the transfer of their assets, regardless of the source of that wealth. It’s important to have the full picture of what this entails before actually setting up residence outside the US. It’s also important to understand residency laws in countries where you live or visit. In some cases, being present in a country for a stated number of days may classify you as a resident for tax purposes.

- The US has tax treaties with many countries and laws change frequently. When your tax liability crosses multiple jurisdictions, staying on top of specific regulations for your location is essential.

- Maintaining a US address and bank account are often beneficial.

- If you plan to work locally or manage your US business from your foreign home, there may be additional tax ramifications to consider.

As a US citizen, you are subject to US estate tax no matter where you live. Additionally, any foreign real estate holdings are part of your US estate. You may also be subject to estate tax in jurisdictions where you reside. Without proper planning, your estate could owe both US and foreign estate taxes on your total holdings.

- Dual citizenship may affect how your estate is taxed.

- Some countries do not recognize US trusts, which could complicate the disposition of your estate.

Living abroad may require changes to your will or other estate documents. For example, the treatment of US trusts could be very different in another country. Because estate laws are so complex and vary greatly, a comprehensive planning approach and having advisors who understand succession laws in every country where you live or own property are essential.

Protecting Personal Health and Safety

Providing for your personal health and safety is fundamental to living abroad. In choosing where to live, you will likely consider economic and geopolitical stability, climate, crime levels, a sense of community, and a strong social fabric. It’s also important to consider access to health care, which may be more or less critical depending on the health of you and your family.

Medicare is not available outside the US and most US health insurance plans do not extend beyond US borders. Some countries allow non-citizen, legal residents to join their public health plans, possibly after a waiting period. However, in most cases, you will probably want a private, international health plan that provides coverage in your new country and when you travel. We can connect you to providers for international insurance.

Another important step is to check in with your doctor before you move. You may need to update immunizations depending on where you plan to travel. You will also want to have enough prescription medication on hand until you establish a relationship with a local doctor and pharmacy.

If your sense of adventure and risk tolerance lead you to a country with unusual threats, such as an unstable government or the possibility of natural disasters, putting an emergency departure plan in place would also be vital for your personal safety.

Connecting to the Right Guidance for a Successful Expat Experience

To manage an event as multi-faceted as a global relocation, you can’t depend on fragmented advice. A comprehensive, multi-disciplinary approach will help you choose a great location and execute your move efficiently, all while ensuring that your wealth plan maintains forward momentum.

Pitcairn takes a proactive approach in helping our clients navigate major life changes and a global move is certainly such a change. From goal- setting to planning to execution, we can coordinate with US-based and local specialists to obtain the expertise you need. We can connect you to the professionals you need, including international tax specialists and locally knowledgeable real estate consultants, property managers, concierge health providers, tax advisors, accountants, and estate planners.

A Trusted Partner Wherever You Go

Contemplating a life outside the US is exciting, but the reality of such a move can feel overwhelming. We never want complexity to keep our clients from fulfilling a dream. Rather, we focus on identifying all potential risks and logistical hurdles and then working through them step by step in order to move forward.

This is something a true family office does. We will be a calm, objective guide, helping you to crystallize your objectives, identify issues, formulate solutions, and build relationships with the advisors you need to make life abroad as rewarding as possible. If living outside the US is something you are seriously considering or something you have only dreamed about, talk to your Pitcairn relationship manager so we can facilitate this great adventure.

Disclaimer: Pitcairn Wealth Advisors LLC (“PWA”) is a registered investment adviser with its principal place of business in the Commonwealth of Pennsylvania. Registration does not imply a certain level of skill or training. Additional information about PWA, including our registration status, fees, and services is available on the SEC’s website at www.adviserinfo.sec.gov. This material was prepared solely for informational, illustrative, and convenience purposes only and all users should be guided accordingly. All information, opinions, and estimates contained herein are given as of the date hereof and are subject to change without notice. PWA and its affiliates (jointly referred to as “Pitcairn”) do not make any representations as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether referenced or incorporated herein, and takes no responsibility thereof. As Pitcairn does not provide legal services, all users are advised to seek the advice of independent legal and tax counsel prior to relying upon or acting upon any information contained herein. The performance numbers displayed to the user may have been adversely or favorably impacted by events and economic conditions that will not prevail in the future. Past investment performance is not indicative of future results. The indices discussed are unmanaged and do not incur management fees, transaction costs, or other expenses associated with investable products. It is not possible to invest directly in an index. Projections are based on models that assume normally distributed outcomes which may not reflect actual experience. Consistent with its obligation to obtain “best execution,” Pitcairn, in exercising its investment discretion over advisory or fiduciary assets in client accounts, may allocate orders for the purchase, sale, or exchange of securities for the account to such brokers and dealers for execution on such markets, at such prices, and at such commission rates as, in the good faith judgment of Pitcairn, will be in the best interest of the account, taking into consideration in the selection of such broker and dealer, not only the available prices and rates of brokerage commissions, but also other relevant factors (such as, without limitation, execution capabilities, products, research or services provided by such brokers or dealers which are expected to provide lawful and appropriate assistance to Pitcairn in the performance of its investment decision making responsibilities). This material should not be regarded as a complete analysis of the subjects discussed. This material is provided for information purposes only and is not an offer to sell or the solicitation of an offer to purchase an interest or any other security or financial instrument.