-

Who We Are

Who We Are

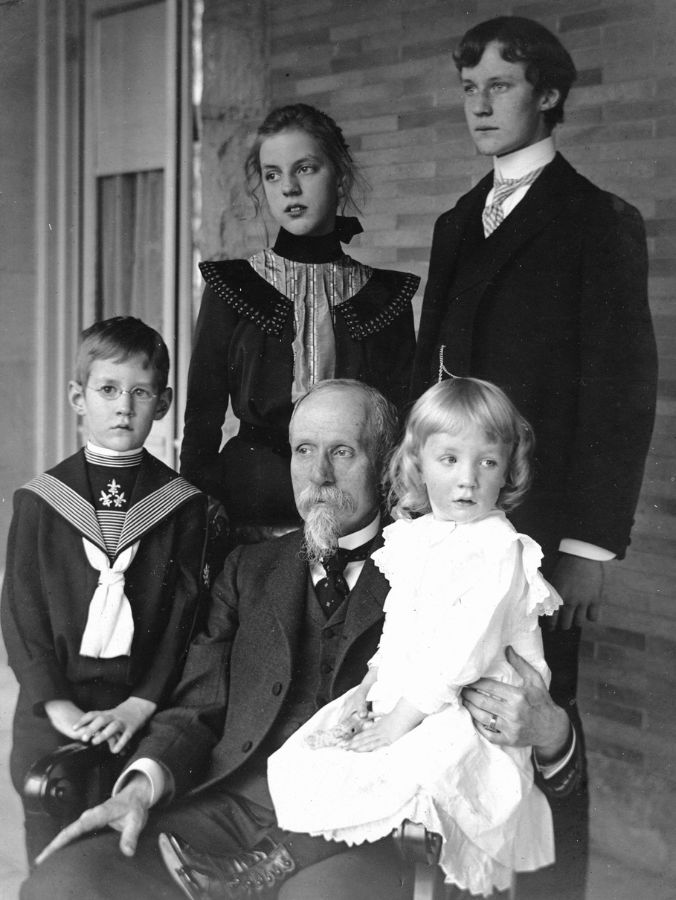

For the last century, we’ve dedicated ourselves to empowering families like yours to prosper and endure. Like many of the leading families we serve, we have been through our own wealth journey.

Discover Pitcairn -

What We Do

Wealth Momentum®

The families we serve and the relationships we have with them are at the center of everything we do. Our proprietary Wealth Momentum® model harnesses the most powerful drivers of financial and family dynamics, maximizing the impact that sustains and grows wealth for generations to come.

Explore - Insights & News

The sooner you think about year-end planning and giving opportunities, the more time you’ll have to make the most of any situation. Economic conditions and your personal circumstances make the final months of 2023 an important time to review your finances.

Income Tax Strategies

Since income tax liability is calculated annually, strategically timing certain financial decisions can help you pay less while playing by the rules.

Defer or accelerate income and capital gains. Deferring income and capital gains until 2024 or accelerating them into 2023 could reduce your tax burden in both years. This strategy may include fully or partially converting an old 401(k) or a traditional IRA to a Roth IRA. You’ll have to predict what might happen next year, and predictions don’t always come true. This opportunity is worth a conversation with your Pitcairn relationship manager — especially if a major change or life event like retirement, a sabbatical, or moving to a new house is on the agenda.

Schedule deductions. Consider bundling medical, charitable, and other Schedule A deductions into one year to surpass the standard deduction and benefit from itemizing.

Lock in capital losses. At Pitcairn, we analyze client portfolios daily for opportunities to realize losses and reduce tax liability. You can deduct up to $3,000 in capital losses from your ordinary income this year and have the ability to carry over additional losses into future years. This would be in addition to any losses that have already been applied against realized gains.

Strategic Timing Can Save On Taxes

Work Benefits

Whether you work for yourself or someone else, you may have benefits that you can use to the fullest extent with a few tweaks before year end.

Maximize retirement contributions. 401(k) and 403(b) plans allow employee contributions of up to $22,500 in 2023 — plus an additional $7,500 if you’re 50 or older. Some 401(k) plans allow additional after-tax contributions as long as total employee and employer contributions don’t exceed $66,000. If you’re maxing out your contributions, a backdoor Roth or mega-backdoor Roth could help you save even more.

Spend FSA dollars. If you’ve contributed to a flexible spending account, make sure you’re on track to incur enough qualified medical expenses by year end to use up every dollar you contributed (the maximum for 2023 was $3,050). If not, now is a good time to book an extra visit with your doctor or dentist. Many people also purchase extra prescription glasses, contact lenses, and over-the-counter medications with surplus FSA funds. If you anticipate higher medical expenses next year, you may be able to roll over up to $610 for 2024 if your employer allows it.

Max out HSA contributions. If you have a high-deductible health insurance plan, you may be eligible to contribute up to $3,850 individually or up to $7,750 as a couple or family to a health savings account. If you (and/or your spouse) are 55 or older, you may (each) be eligible to contribute an additional $1,000.

Take RMDs/QCDs. You’ll incur steep penalties if you don’t take required minimum distributions from your taxable retirement accounts — such as 401(k)s and traditional IRAs — by December 31, 2023. For taxable RMDs that you don’t need for living expenses, you may wish to take a qualified charitable distribution of up to $100,000 instead. That money won’t be included in your annual adjusted gross income and could be part of your overall philanthropic giving.

Gift, Estate, and Intergenerational Planning

Here are several gifting and estate-planning items to consider before December 31.

Take advantage of annual exclusion gifts. If you haven’t used up your annual exclusion gifts, now is the time. Individuals can give up to $17,000 per recipient, without a limit on the number of recipients, in 2023. These can be cash gifts, but in some cases, it could make sense to give depreciated investments that have high growth potential.

Provide the gift of education. Some families may find value in using their annual exclusion gifts to fund a 529 plan in the name of a child or grandchild who is likely to attend college. Parents and grandparents can use this strategy to remove assets from their taxable estates without using up any of their lifetime estate tax exclusion — while contributing to future education expenses in tax-advantaged accounts. In addition, tuition payments that are made directly to an educational institution are exempt from gift taxes and therefore do not count towards the annual exclusion amount.

Compound your gift. A 529 plan can be pre-funded with up to five years’ worth of annual exclusion gifts in a single year ($85,000), creating more time for compound growth.

Help fund a charity. Along with giving to family, you may want to give to your favorite charities. Whether you give cash, appreciated stock (especially low-basis stock), or other assets, you may be able to reduce your taxable income (or taxable estate) while making a profound difference in someone else’s life.

Update planning documents. It’s never a bad time to make sure your estate plan is up to date. Who are the beneficiaries on your payable-on-death accounts and your life insurance policies? Do your existing trustee appointments and bequests still fit your overall wealth plan and objectives? It may be time to remove an ex-spouse, add a child, or change a trustee.

Appoint personal representatives. Everyone should consider appointing a healthcare proxy and financial power of attorney. You’ll need witnessed or notarized documents to name reliable individuals to legally make health and financial decisions on your behalf in the event of incapacitation. The events that can render us incapacitated often arrive without warning, so it’s best to appoint trusted representatives, whether you expect to need their help or not.

Closing Thoughts

We hope this guide has piqued your interest in financial moves that could be worth making before year end. Reach out to your Pitcairn relationship manager for a personalized analysis and discussion. Then, let us handle the logistics while you enjoy a much-needed break.